Modern slavery is the illegal exploitation of people for personal or commercial gain. It is a global, systemic issue, and occurs frequently in multinational corporations and their supply chains due to complex, global networks. Currently 24.9 million people are impacted worldwide, with 16 million victims of forced labour in the private sector. Modern slavery carries regulatory, financial and reputational impact, especially as new legislation is being increasingly enforced, such as the UK’s Modern Slavery Act which specifically states in Section 54, entitled ‘Transparency in Supply Chains', that all businesses with over £36m in annual turnover conducting business in the UK must publish a slavery and human trafficking statement. If companies are found to be non-compliant, they face fines of up to 4% of their annual turnover.

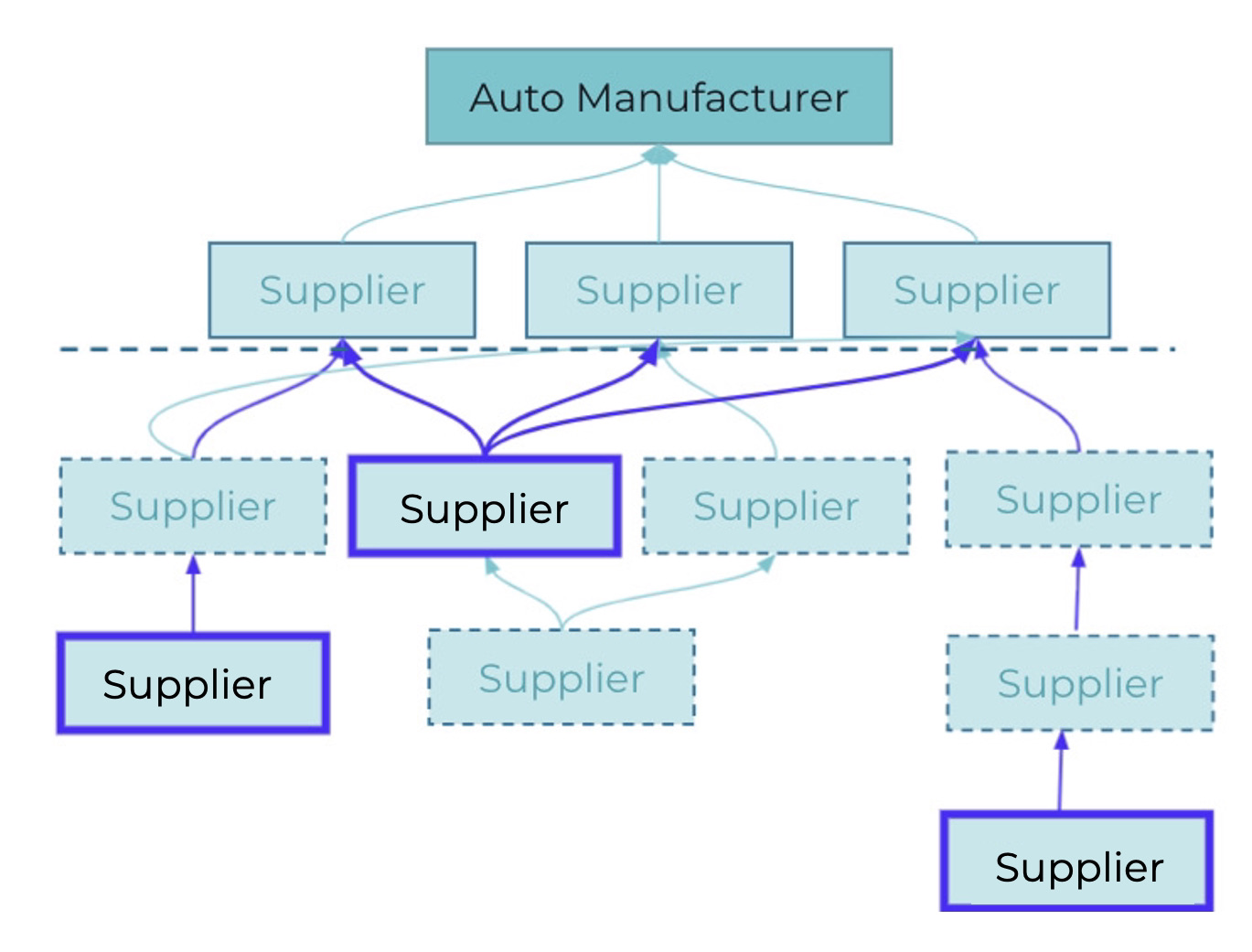

Companies tend to be unaware of modern slavery in their supply chain due to a lack of visibility into their extended supply chains. Versed AI can provide clients with this multi-tier visibility, identifying and mapping suppliers below the top tier.

Versed AI enables improved ROI from supplier audits from the identification of high-risk modern slavery hotspots and common sub-tier suppliers. From this data, companies can better target where supplier audits should be done, improving compliance with modern slavery regulations and reducing reputational risk.

Multi-tier supply chain analysis can help identify the biggest modern slavery risks in the supply chain

Increasing Legislation

In 2015, the UK became the first country in the world to require businesses to report on their progress to identify and address modern slavery risks in their operations and supply chains with the Modern Slavery Act of 2015 (MSA). In the UK, non-compliance can result in penalties of up to two years imprisonment for individuals and a fine amounting to 4% of annual global turnover, up to £20m. In September 2020, the UK government announced that the MSA transparency requirements for private firms would be extended to the public sector and there are now plans to strengthen the current legislation. Since 2015, other countries have recognised the importance of such legislation, and started to implement tough measures themselves. This includes Australia’s Modern Slavery Act, the California Transparency in Supply Chains Act and Germany’s Due Diligence Act will come into effect in 2023.

The United States has also strengthened its modern slavery regulations. In 2016, the Trade Facilitation and Trade Enforcement Act was introduced making it is illegal to import goods into the United States that are made entirely or in part by forced labour - which includes prison work, bonded labor and child labour. U.S. companies should carry out due diligence to assess the risks in their supply chains, as a company must provide proof that every effort was made to determine the type of labour used in the production of each component. If they can’t, they may face import holds of up to 90 days, potentially causing significant financial losses, operational setbacks and even brand damage. In January 2021, U.S. Customs and Border Protection began to detain all tomato and cotton products from China’s Xinjiang Uyghur Autonomous Region (XUAR) after they identified a range of forced labour indicators in the region. Visibility of modern slavery risk in the supply chain is crucial to avoid issues such as this.

There is a range of other key global legislation, such as France’s Loi de Vigilance, which requires large companies to assess and address the adverse impacts of their activities on people and the planet through annual public reports, or face fines of up to €10 million. The law enables fines to rise to €30 million if this failure resulted in damages that would otherwise have been preventable. The specific requirements that companies must follow in France make it one of the most stringent regulatory frameworks in terms of sanctions. In Canada, newly enacted Bill S-216 requires entities that have at least $20 million in assets; have generated at least $40 million in revenue; or employ an average of at least 250 employees to publicly display their modern slavery reports in a prominent place on their website. These reports must outline any actions taken during that financial year to prevent and reduce the risk of child and forced labour being used in the entity’s supply chains. If any entity is found guilty of non-compliance to this legislation, they are liable to a fine of up to $250,000 per offence, alongside director, officer and agent liability.

It’s clear that more and more countries are introducing modern slavery legislation, with the Netherlands implementing The Dutch Child Labour Due Diligence Law, which will come into effect in mid-2022. The EU is expected to adopt a legal framework for companies around their subcontractors, after a call for European Union legislation on mandatory human rights due diligence from Anti-Slavery International, along with a large coalition of NGOs and trade unions. This is reinforced by the UN, who provide a range of references, including international guiding principles on business and human rights with their “Protect, Respect and Remedy” framework.

Global Performance and Compliance

Performance on modern slavery varies significantly by country. The Walk Free Global Slavery Index shared a government response index measuring government efforts to stop sourcing goods and services produced by forced labour. The Global Slavery Index assesses governments on indicators of good practices and found that the USA is currently ahead of the curve, with a score of 65% on its scale, compared to 26.7% in the UK and an 11.5% global average.

Since the UK introduced its legislation in 2015, some companies haven’t been as compliant as hoped, leading the government to strengthen legislation as a result, with new proposals being made to the 2015 MSA in June 2021. Proposed additions to the amendment include making it a criminal offence to supply a false modern slavery and human trafficking statement; making it a criminal offence for companies to continue to use supply chains which fail to demonstrate minimum standards of transparency; and to improve standards of transparency in supply chains in relation to modern slavery and human trafficking. As pressure increases from a range of stakeholders - that of the government, investors, and consumers, businesses will now be held to high account in adhering to compliance and delivering a clear statement about their efforts to eradicate modern slavery in business.

Ethical Obligations: Increasing ESG Pressure

There is increasing ESG pressure on companies to monitor their ethical progress, and action on modern slavery from investors is gaining momentum. Recently, a £3.2 trillion investor coalition titled ‘Votes Against Slavery’, which includes Aberdeen Standard Investments, Church of England Pensions Board, Legal & General and Rathbones, has put pressure on 22 companies on the FTSE 350 to comply with the UK’s modern slavery laws, due to investors' increasing concern about modern slavery compliance. Votes Against Slavery says it took aim at the UK’s largest companies because “by being active themselves, FTSE350 companies can have a ‘multiplier’ effect as their actions will incentivise further compliance down their supply chains”. Investors are increasingly avoiding companies which do not have a good ESG profile, leading to lower share prices for weaker performers.

The benefit of companies complying with ESG standards is clear for investment opportunity. The share of global investors that have applied ESG criteria to at least a quarter of their total investments has jumped from 48% in 2017 to 75% in 2019, according to data from Deloitte.

Real Economic Costs

Poor human rights due diligence and a lack of compliance with modern slavery laws is also starting to have tangible economic costs for companies. In a new development, a recent report from Fitch Ratings notes that non-compliance with modern slavery laws is likely to have an impact on company credit ratings in future. This is significant as reduced corporate credit ratings means that failure to take action on modern slavery could increase the cost of company debt.

Reputational Risk

Beyond the ethical implications, the reputational and financial repercussions can be huge. Alongside potential loss of investment, companies who are found to have modern slavery in their supply chains can experience damaged credibility across their customer base, particularly if the media identifies such an issue, as seen with Boohoo, who caused media outcry when their Leicester factories were found to be paid less than minimum wage, in poor conditions.

The value of Boohoo initially fell by £1 billion, and required the company to undertake a major overhaul to salvage their reputation, cutting ties with 64 factories, consolidating others, and cutting out subcontracting, alongside firmly improving their auditing process. Whilst this extensive damage repair enabled their value to recover, the reputational impact remains apparent. A YouGov survey found that beyond negative headlines, Boohoo’s reputation scores – which were slightly positive before the modern slavery story was published, plummeted after numerous reports featuring allegations of slave labour emerged. On July 5th 2020, scores fell to -3, and by July 9, they plummeted to -11, a sharp decline in public perception. Boohoo are also facing a possible US import ban, showing the extent of damage a company can incur from involvement with modern slavery.

The risk to companies' reputations is increasing with the rise in information transparency. Social media and NGOs are helping to surface more and more instances of modern slavery, and this is not just in the extensively-profiled food and garment industries. For instance, US based fair-labour organisation Verite’s two year study into the Malaysian electronics sector found one in three foreign workers were working in conditions of forced labour.

In 2019, a lawsuit was filed against huge tech names including Apple, Tesla, Google and Microsoft, about their extraction of cobalt from The Democratic Republic of Congo, linking this to human rights abuses, corruption, environmental destruction and child labour. High coverage of this case displays the severe public impact that companies can face if they’re found to be non-compliant with established modern slavery legislation. Companies in all industries need to be aware of reputational risks from their supply chains and take steps to mitigate.

Benefits of Transparency

As companies chase lower profits, exploitation increases, and so does the risk of modern slavery appearing in the supply chain. However, transparency may increase profits, with customers 2% to 10% more willing to pay for products with full transparency.

Patricia Carrier, of the Modern Slavery Registry, says that “given the prevalence of modern slavery in global supply chains, we know that most global companies will have it somewhere in their supply chains, very far down where they don’t have much visibility or leverage.” Versed AI can expose the supply chain, through its natural-language processing and machine-learning technology, identifying suppliers at the multi-tier level, and identifying factory locations, which can then be matched against third party datasets about modern slavery.

Companies risk losing consumer confidence and market share if they are found to be sourcing from suppliers which use exploitative labour. A report from Reuters suggests that consumer action against companies linked to slavery costs those implicated £2.6bn a year.

Companies such as Tony’s Chocolate have set the standard for transparency in action, with a mission to end slavery in the chocolate industry. They are leading an initiative to support the introduction of a Dutch child labour due diligence law. This ethical practise has increased the company’s brand value substantially, with a Reuters article reporting that Ben Greensmith, UK country manager for the company, stated that the initiative “has proven very successful for us. We’ve grown from zero to market leader in the Netherlands in 12 years and are now expanding rapidly internationally.”

In Conclusion

The bar for modern slavery compliance is becoming higher and companies are having to put more resource into human rights due diligence because of growing reputational risks, investor pressure and regulatory pressure. Governments, consumers, and society on the whole are becoming increasingly concerned with modern slavery in business and it’s one of the most significant issues in a supply chain.

Identifying modern slavery in the supply chain not only increases a company’s credibility and ESG compliance, but is essential for businesses who don’t want to incur vast fines, lose investment, face a loss of consumer trust, and even face imprisonment. The ethical nature of modern slavery should alone make companies want to take action, yet if this isn’t enough, the extensive repercussions show the benefits of modern slavery compliance, so it’s crucial for a company to seek full visibility across the supply chain in order to prevent this.

Versed AI can help pinpoint potential modern slavery risks by exposing companies in the extended supply chain, which can then be matched up to modern slavery data. Versed AI offers a range of services for companies, including mapping out members of a company’s extended supply chain, down to tier n, identifying factory addresses in the supply chain. These enable a company to meet regulatory obligations, triage where to send supplier audits, improving return on investment, and help protect their brands and reputations. For more information, go to versed.ai